Achieving Financial Harmony: Our Review of ‘Your Money, Life and Wife

In our quest for financial stability and stronger relationships, we recently delved into “YOUR MONEY, LIFE AND WIFE: How to Build Financial Harmony, Strengthen Relationships, and Achieve Personal Growth.” This easy-to-read guide offers a refreshing perspective on balancing money management with personal connections. The author’s pragmatic approach encourages open communication between partners, making it a practical gift for those embarking on new stages of life or simply looking to revitalize their financial harmony.

Throughout the book, we found valuable insights that not only shed light on budgeting and saving but also emphasize the importance of shared goals and mutual support. Each chapter is packed with actionable tips that we can immediately apply, fostering both personal growth and relationship strengthening. Overall, we highly recommend this book as a resource for anyone aiming to enhance their financial and relational well-being.

Empowering Our Teens: A Review of ‘Grow Money & Master Finances

In our quest to equip our teens with essential life skills, we recently delved into “Grow Money & Master Teen Finances.” This book stands out as a powerful tool that not only demystifies personal finance but also empowers young minds to take charge of their financial futures. The straightforward, actionable steps guide readers through earning income, budgeting, saving, and investing, all in a relatable format that resonates with today’s youth. We appreciate how the author integrates real-world examples and interactive exercises, making complex concepts accessible and engaging. This resource does more than just educate; it fosters a mindset geared towards building wealth and financial independence. For parents and educators alike, “Grow Money & Master Teen Finances” is an invaluable addition to our toolkit, ensuring that our teens are not just consumers but savvy stewards of their financial journeys.

Unlocking Income Independence: Our Review of Retirement Money Secrets

In our quest for financial independence in retirement, we recently delved into “Retirement Money Secrets: A Financial Insider’s Guide to Income Independence”. This comprehensive guide stands out for its clear, actionable advice tailored to various income streams, catering to both novices and seasoned investors alike. We were particularly impressed by the author’s insider knowledge, which sheds light on often-overlooked strategies that empower readers to take control of their financial futures. The book not only demystifies complex concepts but also provides practical steps to achieve sustainable income throughout retirement. Each chapter is structured logically, making it easy for us to follow along and implement the strategies discussed. Overall, “Retirement Money Secrets” is an invaluable resource that equips us with the tools needed to navigate our financial landscape with confidence. We wholeheartedly recommend it to anyone seeking to unlock the door to true income independence.

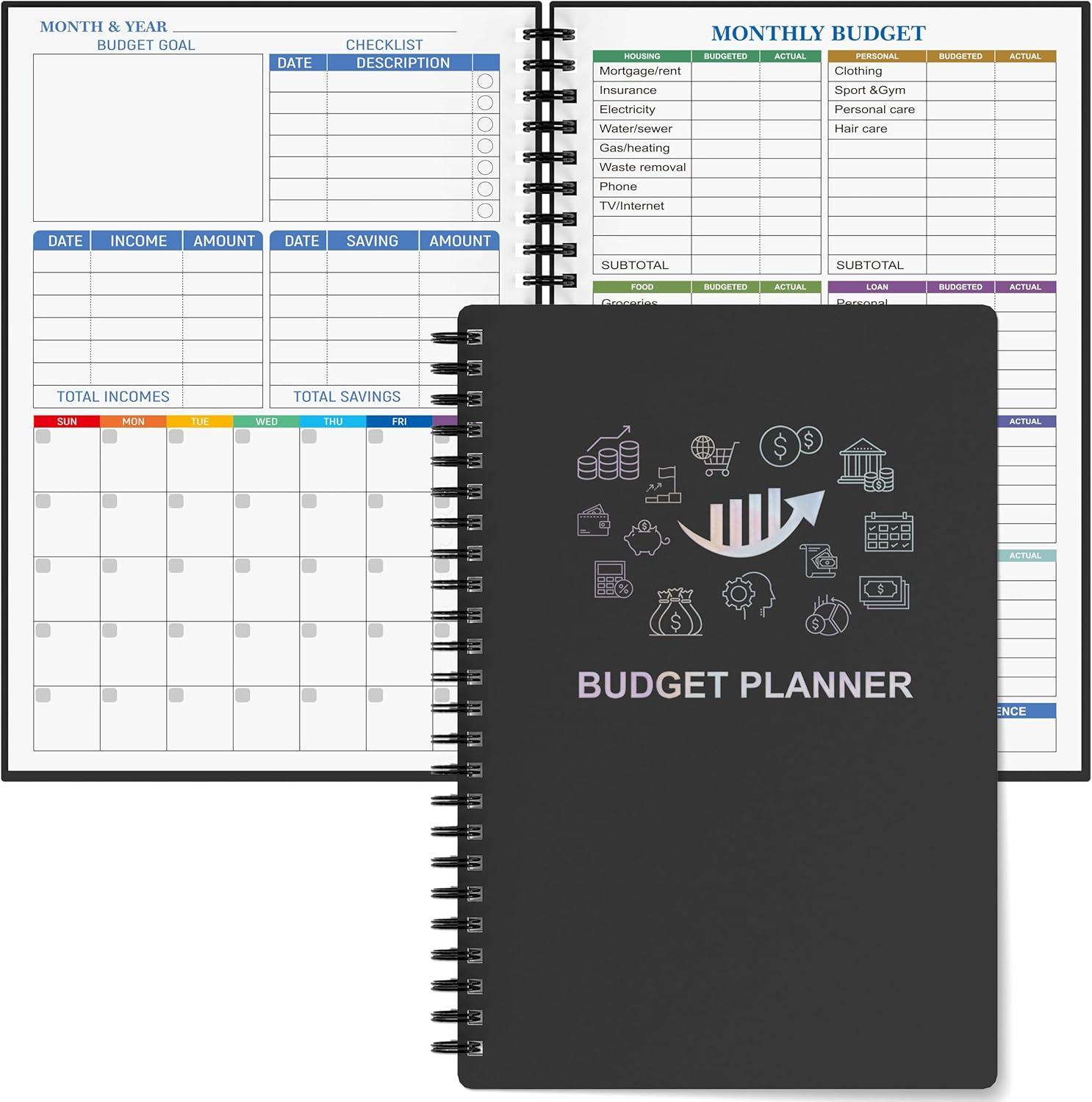

Maximize Your Finances: Our In-Depth Review of the Snootion Budget Planner

In our quest for effective financial management, we turned to the Snootion Budget Planner, an undated monthly finance organizer designed to help us track our expenses and optimize our budgeting efforts. With its portable A5 size and high-quality 100gsm paper, we found it not only functional but also a pleasure to use. The structure of the planner allows for flexibility, enabling us to start at any point in the year—an essential feature for those of us who want to take control of our finances without the constraints of traditional planners. The clean layout makes it easy to log expenses and categorize our monthly goals, ultimately providing us with a clear overview of our financial health. Overall, the Snootion Budget Planner has proven to be a vital tool in our financial journey, and we highly recommend it for anyone looking to enhance their money management skills.

Transforming Our Finances: A Review of ‘Rich AF’ by Vivian Tu

In “Rich AF: The Winning Money Mindset That Will Change Your Life,” Vivian Tu offers a refreshing and impactful perspective on personal finance that resonated deeply with us. This book is not just a guide to budgeting; it’s a transformative blueprint for reshaping our financial mindset. Tu encourages readers to break free from limiting beliefs and offers actionable strategies that empower us to take control of our money.

We particularly appreciated the real-life examples and relatable anecdotes that made complex financial concepts accessible. Furthermore, Tu’s engaging, no-nonsense style kept us motivated throughout our reading journey. By the end, we felt equipped not only with practical tips but also with a renewed confidence in our ability to achieve financial success. Overall, “Rich AF” is an invaluable resource that will undoubtedly leave a lasting impact on our financial lives.

Unpacking Investment Wisdom: Our Review of Malkiel’s Guide

In “A Random Walk Down Wall Street,” Burton Malkiel presents a compelling and accessible guide to investing that resonates with both novices and seasoned investors alike. As we delved into the text, we appreciated Malkiel’s ability to distill complex concepts into digestible insights, making the world of finance feel less intimidating. His emphasis on the efficient market hypothesis challenges traditional stock-picking strategies, encouraging us to embrace index funds for long-term success. We found his real-world examples and straightforward language particularly effective in demystifying market behaviors. However, while Malkiel’s perspectives are undoubtedly valuable, readers should also consider supplementing his strategies with a broader understanding of financial tools. Overall, we strongly recommend this book for anyone looking to enhance their investment acumen and navigate the stock market with confidence.

Mastering Money: Our Deep Dive into ‘Personal Finance For Dummies

In our quest to demystify personal finance, we turned to “Personal Finance For Dummies,” a staple in financial literature. This book stands out for its approachable language and structured content, making complex concepts accessible to readers at any level. We appreciated how it covers essential topics, from budgeting and saving to investing and retirement planning, all while incorporating practical tips and real-life examples. The use of helpful summaries and checklists throughout the chapters allows us to consolidate our learning effectively. While some might find its tone a bit simplistic, we believe this enhance its usability for those who may feel overwhelmed by financial jargon. Overall, “Personal Finance For Dummies” serves as an invaluable resource for us, providing the foundation needed to take control of our financial future.

Unlocking Financial Success: Our Review of Personal Finance For Dummies

In our quest for financial literacy, “Personal Finance For Dummies” stands out as an invaluable resource that demystifies the often daunting world of personal finance. From budgeting basics to retirement planning, this book offers a comprehensive guide that caters to readers at all stages of their financial journey. Its approachable language and clear structure make complex concepts accessible, transforming them into actionable steps.

We particularly appreciate the practical tips and real-world examples that empower us to take charge of our finances with confidence. The chapters on saving and investing are particularly well-crafted, providing clarity on how to grow our wealth over time. Overall, “Personal Finance For Dummies” is not just a book; it’s a practical toolkit for anyone seeking to understand and improve their financial situation, making it an essential addition to our personal finance library.

Exploring Financial Literacy for Young Adults: A Review

In our exploration of “Financial Literacy for Young Adults Simplified,” we found this resource to be a comprehensive guide tailored for those entering adulthood. This book effectively breaks down complex financial concepts into digestible sections, making it accessible for readers with varying levels of financial knowledge. We appreciate the clear explanations surrounding key topics such as budgeting, saving strategies, and investing basics, which are crucial for building a secure financial future. The practical tips and real-life examples not only engage young adults but also encourage them to take actionable steps toward financial independence. Overall, this book serves as an excellent starting point for young adults seeking to navigate the often daunting world of personal finance. Its structured approach and relatable content make it an invaluable addition to anyone’s financial education journey.

Evaluating the Clever Fox Budget Planner for Effective Finances

In our quest for better financial management, we decided to evaluate the Clever Fox Budget Planner – an all-in-one expense tracker designed to help us organize our finances efficiently. This A5-sized planner, available in a vibrant red, is tailored for monthly budgeting, providing dedicated sections for logging expenses, tracking bills, and keeping an eye on our overall financial health. The layout is intuitive, allowing us to easily categorize our expenses and monitor our spending habits. We appreciated the durable cover and the high-quality paper, which adds to the overall user experience. However, we noticed that some pages could benefit from additional prompts to guide us through the budgeting process. Overall, the Clever Fox Budget Planner proves to be a valuable tool for anyone seeking to gain control over their financial situation.

Exploring the Teen Finance & Business Success Collection

In our exploration of the “Teen Finance & Business Success Collection,” we found a comprehensive resource designed to empower young individuals looking to turn their skills into successful ventures. The collection offers three key components: guidance on rapidly launching a business, strategies for building wealth while maintaining personal passions, and insights into smart investing for long-term financial growth. We appreciated the straightforward language that makes complex financial concepts accessible to a younger audience. Each segment is rich with practical advice, real-world examples, and actionable steps that encourage teens to take control of their financial futures. Overall, this collection serves as an excellent starting point for teens eager to navigate the world of finance and entrepreneurship effectively. Whether you’re a budding entrepreneur or just looking to improve your financial literacy, this resource has something valuable to offer.

Transforming Finances: Our Review of a Young Adult Guide

In our exploration of personal finance resources for young adults, “The 7-Steps from Money Slave to Money Master” stands out as a practical guide tailored specifically for teens and college students. This quick-start guide effectively breaks down complex financial concepts into manageable steps, making it accessible for those just beginning their financial journeys. We appreciate the straightforward language and engaging format, which encourage readers to take immediate action. Each chapter provides actionable tips, from budgeting basics to understanding credit, ensuring that readers can not only grasp the information but also apply it to their own lives. Overall, we find this book to be a valuable tool that empowers young adults to take control of their finances and set a strong foundation for their financial futures.

Exploring ‘Rich AF’: A Review of Financial Mindset Transformation

In our exploration of “Rich AF: The Winning Money Mindset That Will Change Your Life,” we found a comprehensive guide aimed at reshaping our financial perspectives. The book presents a series of actionable strategies designed to foster a positive relationship with money. By emphasizing the importance of mindset, the author encourages us to challenge limiting beliefs and adopt a wealth-oriented outlook. The layout is user-friendly, with practical exercises interspersed throughout the chapters, allowing us to engage actively with the concepts presented. However, we noted that some ideas may resonate more with beginners in financial literacy, while seasoned readers might find the content less challenging. Overall, “Rich AF” provides valuable insights for anyone looking to enhance their financial mindset and achieve lasting success.

Our Comprehensive Review of ‘A Random Walk Down Wall Street

In our comprehensive review of “A Random Walk Down Wall Street,” we explore the enduring relevance of Burton Malkiel’s investment classic. First published in 1973, this book presents a blend of historical analysis and practical advice for both novice and seasoned investors. We appreciate Malkiel’s clear explanations of complex financial concepts, particularly his advocacy for a passive investing strategy through index funds. This approach resonates well with our belief in long-term financial planning and diversification. Additionally, the author’s exploration of market inefficiencies and behavioral finance offers valuable insights into investor psychology. While some may find his dismissal of active management controversial, we believe that Malkiel’s arguments are well-supported and grounded in evidence. Overall, “A Random Walk Down Wall Street” serves as a foundational resource, making it a worthy read for anyone interested in understanding the dynamics of the stock market.

Exploring ‘Personal Finance for Dummies, 9th Edition’: Our Review

In our exploration of “Personal Finance for Dummies, 9th Edition,” we found it to be a comprehensive guide that simplifies complex financial concepts for readers at any level. The book covers a broad range of topics, from budgeting and saving to investing and retirement planning, making it a versatile resource for managing personal finances. The clear explanations and practical tips are particularly beneficial for beginners who may feel overwhelmed by financial jargon.

We appreciated that the 9th edition includes updated information reflecting recent changes in tax laws and economic trends, ensuring relevance in today’s fast-paced financial landscape. Additionally, the friendly, accessible tone aligns well with the series’ trademark style, making learning about finance less intimidating. Overall, we believe this edition serves as a valuable tool for anyone looking to improve their financial literacy and make informed financial decisions.

Our Insights on the Study Guide to Technical Analysis

In our exploration of the “Study Guide to Technical Analysis of the Financial Markets,” we found it to be a valuable resource for both novice and experienced traders. This guide, published by the New York Institute of Finance, presents a comprehensive overview of various trading methods and applications, effectively bridging theory and practice.

The structured format enhances readability, making complex concepts more accessible. Each chapter is filled with illustrative examples and practical exercises, further reinforcing key principles. Additionally, the inclusion of real-world case studies adds a pragmatic dimension that we appreciate. However, while the depth of content is impressive, some readers may find certain sections require prior knowledge of financial terminology. Overall, we believe this study guide serves as a robust foundation for anyone looking to deepen their understanding of technical analysis in the financial markets.