Need some extra cash to help with your business? Acquiring a loan may be very intimidating, but it can be the best way to get over a financial hurdle. You don’t need to overthink about falling into debt. With the right amount of preparation, finding the right business loan is an easier task than what most people think.

Here are the things you need to establish before getting one.

1. What is your purpose? How much do you need?

Before anything else, you should know how much you need and tell your lenders how you plan on using the loan. The more specific, the better. If you’re planning to buy equipment, you should inform them of the model and quantity. If you want to hire new staff for your business, indicate the specifics of their position and the exact number of people you are hiring.

All lenders have a floor and ceiling (minimum and maximum amounts that they are willing to give), and determining how much you need will define what type of loan you should get.

2. What is your current amount of debt?

While a loan may help you get over a financial hurdle, accumulating debt is unwise. Lenders will look at your debt-to-income ratio to measure how your business’ income stacks up with your monthly debt payments. All banks and personal lenders avoid risky scenarios and may not lend you cash if you have too much debt.

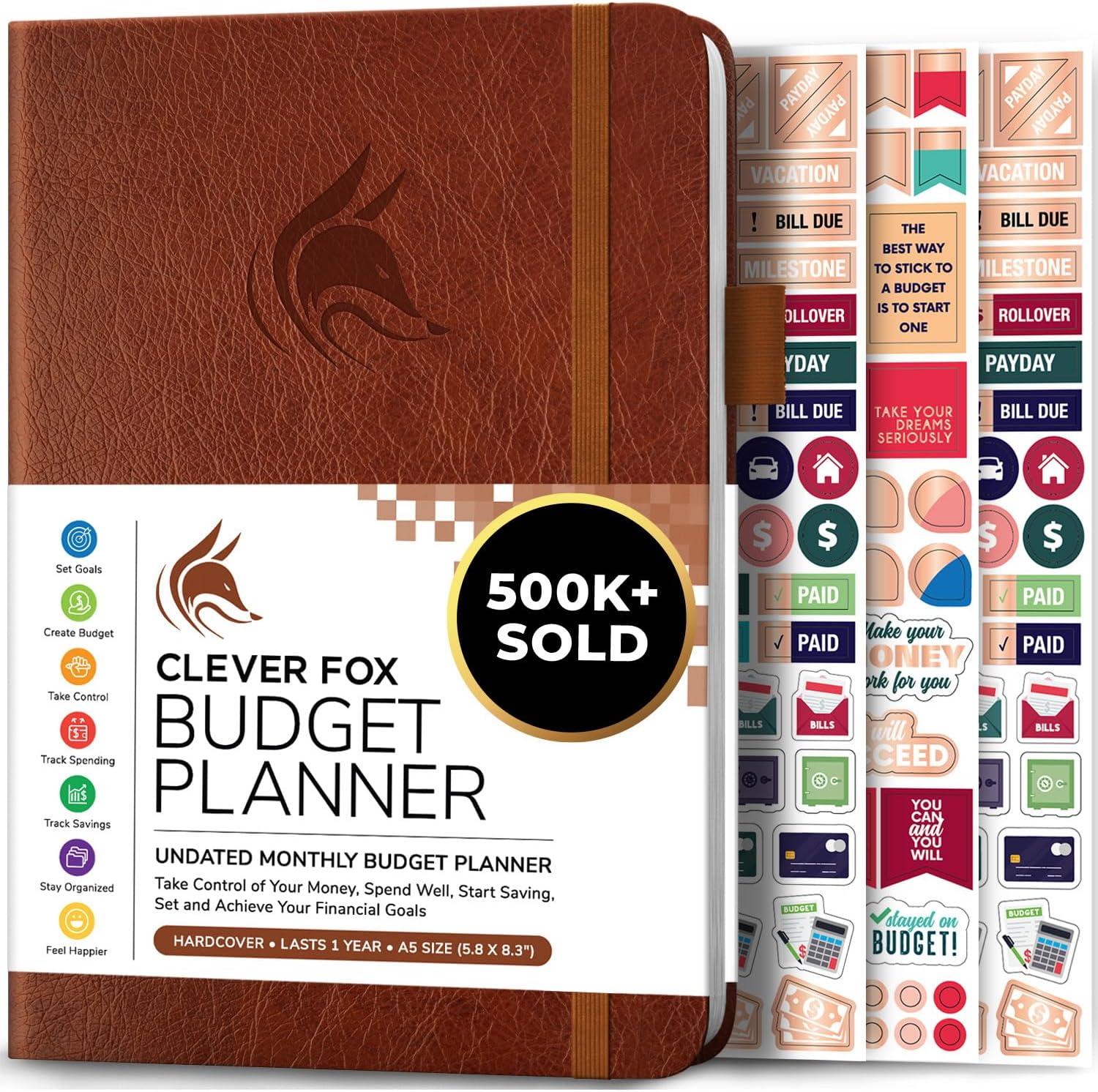

Manage your finances well. Documenting your expenses and making a monthly payment plan can help you out.

3. How is your personal/business credit score?

Maintaining good credit is essential because it determines how high your interest rate will be. Lenders will ask for you a record of your personal credit history to assess the likelihood of you paying them back. Your personal/business credit score reflects how you handle your finances, so a good credit score will let your lenders know that you will be able to manage your money well.

Keep in mind that all banks and lenders work differently. Each option has its own share pros and cons, so it’s essential to assess what your situation demands.

4. Do you have a business plan?

Not all lenders will require a business plan, but having one is beneficial. If you are in the development stages of your business, do know that lenders are wary of lending to startups. If they do lend, interest rates are generally higher.

This is an opportunity to show how passionate you are with your business and that you are going to spend the loan money for a good cause. Preparing a well thought out business plan will help you establish what your financial goals (profit, income, cash flow, etc.) are and figure out the necessary steps you to achieve them.

5. How long has your business been running?

Younger businesses have lower survival rates.

As previously mentioned, new businesses may have a hard time acquiring a loan and if they do get one, interest rates might be higher. Did you know that only 25% of businesses have made it past 15 years? Most banks require a minimum business age that ranges from 6 months to two years to eliminate possible risks.

At the early stages of your business, acquiring a loan is not a safety net. In case your company fails, acquiring a loan that early may accumulate and grow, affecting you for years to come. Give some time for your business to age. Longevity will often lead to a good deal because it will show the lender that your business is stable enough.

6. What kind of industry are you in?

One factor banks and lenders consider is the type of industry your business is in. If the risk factor is high or if it is socially undesirable, chances are you will get rejected. Lenders will also make their reputation a priority by blacklisting certain industries such as firearms and adult entertainment.

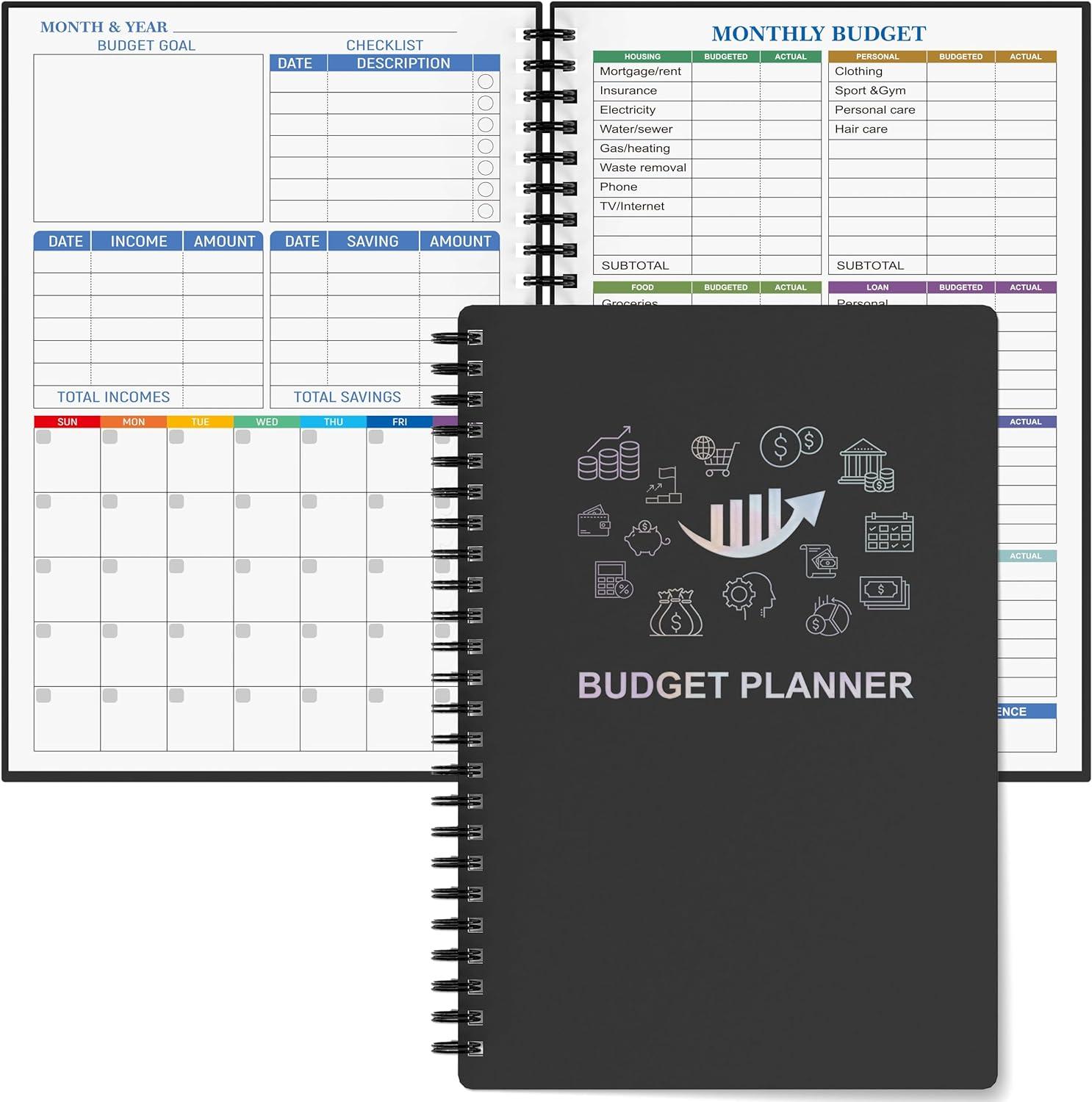

7. Do you have a stable stream of income?

Your cash flow is the main indicator of your business’ health.

A steady stream of income demonstrates that you can make monthly payments. Lenders will need to assess your businesses’ income and expenses to establish a debt-to-income ratio properly. Prepare important documents like income statement to ensure higher chances of approval!

Choosing the right loan

All lenders have their pros and cons, so take the time to search and study different offers. Looking at the big picture will let you choose a more cost efficient option! For big loans that will take some time to pay off, acquiring a loan from a bank/lender is a better option. For small loans that you can pay within a year, having a credit card is your best bet.

The post 7 Essential Things to Consider Before Getting A Business Loan appeared first on Easy Info Blog.